The Georgia trucking industry is booming—and so are the risks that come with it. Whether you’re a new carrier applying for your USDOT number or a seasoned fleet owner expanding operations, commercial truck insurance in Georgia isn’t just a formality. It’s a legal and financial necessity.

What Is Commercial Truck Insurance in Georgia?

Commercial truck insurance in Georgia is a set of insurance policies designed to protect motor carriers, owner-operators, and freight businesses from liability and financial loss due to accidents, theft, cargo damage, and more.

If your truck is used for business, personal auto insurance won’t cut it.

What Does It Typically Cover?

✔️ Bodily injury and property damage liability

✔️ Collision insurance (vehicle-to-vehicle or object impact)

✔️ Comprehensive insurance (non-collision damage: fire, theft, vandalism)

✔️ Cargo insurance

✔️ Uninsured/underinsured motorist protection

💡 Related: Do You Need Help Setting Up Your USDOT & MC Number? Start Here

Georgia’s Legal Requirements for Commercial Truck Insurance

The Georgia Department of Public Safety and FMCSA require specific minimum insurance levels for different vehicle types and cargo classes.

Minimum Liability Coverage:

- $750,000 – General freight

- $1,000,000 – Oil transport

- $5,000,000 – Hazardous materials

- $300,000 – Non-hazardous freight under 10,001 lbs

Note: These are federal minimums. Georgia also enforces state-specific requirements for intrastate operations.

For intrastate-only carriers, check Georgia-specific regulations through Georgia Department of Revenue – Motor Vehicle Division.

Get Help Finding Better Insurance Rates Today!

Types of Commercial Truck Insurance Coverage

Choosing the right coverage mix protects your business and ensures FMCSA compliance. Here’s a breakdown of the most common commercial truck insurance types:

✅ Liability Insurance (Required)

Protects against injuries and property damage you cause to others.

✅ Physical Damage Coverage

Covers repairs or replacement if your truck is damaged in a crash, vandalized, or stolen.

✅ Cargo Insurance

Covers loss or damage to freight in your care.

✅ Uninsured/Underinsured Motorist

Helps if you’re hit by someone who doesn’t carry adequate insurance.

✅ Bobtail Insurance

Covers non-dispatch driving when not hauling a trailer.

✅ Trailer Interchange Insurance

Protects non-owned trailers in your possession.

✅ General Liability Insurance

Covers injury or property damage not directly involving your truck (e.g., delivery mishaps).

Learn more about trucking insurance requirements directly from FMCSA’s website.

Dump Truck Insurance in Georgia: Specialized Coverage

Dump trucks face higher liability due to their heavy-duty use. If you operate one in Georgia, make sure your policy includes:

- Primary auto liability

- Physical damage (collision/comprehensive)

- Non-owned trailer or equipment coverage

- Environmental and pollution liability (for hauling debris, chemicals, etc.)

Some carriers also require special filings (e.g., Form E or H) to prove financial responsibility for hazardous operations.

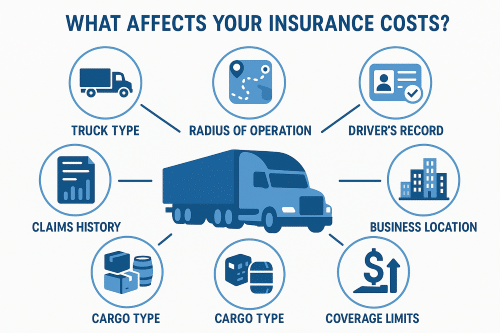

Factors That Affect Truck Insurance Costs in Georgia

Insurance isn’t one-size-fits-all. Georgia carriers will find that costs vary significantly based on:

🛻 Truck Type – Heavier, specialized, or long-haul trucks have higher premiums.

🧭 Radius of Operation – Local vs. long-distance hauls affect risk level.

👤 Driver’s Record – Clean MVRs (Motor Vehicle Records) reduce rates.

📍 Business Location – Urban areas typically mean higher premiums.

🧾 Coverage Limits – Higher coverage = higher cost.

📦 Cargo Type – Hazmat and high-value cargo increase risk exposure.

📊 Claims History – More claims can result in higher premiums.

How to Get the Cheapest Commercial Truck Insurance in Georgia

Here’s how smart motor carriers keep their premiums low without cutting corners:

1. Shop and Compare Quotes

Don’t settle on the first quote. Compare options from companies like Progressive, The Hartford, and GEICO Commercial.

2. Use a Transportation Insurance Specialist

Working with a broker experienced in Georgia commercial trucking can uncover niche programs and discounts.

3. Maintain a Clean Driving Record

Encourage driver training programs and strict hiring standards.

4. Bundle Policies

Many insurers offer fleet discounts when combining liability, cargo, and physical damage.

5. Install Telematics

GPS tracking and ELDs can help lower premiums and improve DOT compliance.

Top Commercial Truck Insurance Providers in Georgia

Georgia is home to several reliable commercial insurance carriers. Here are five trusted names to get you started:

- Progressive Commercial – Competitive pricing and fast certificates.

- State Farm – Known for responsive local agents.

- The Hartford – Offers tailored commercial vehicle packages.

- Nationwide – Good for fleets and bundled coverage.

- GEICO Commercial – Simple claims process and 24/7 support.

Pro tip: Ask your broker which carriers specialize in new authority holders vs. seasoned operators.

Trucking Authority Services

Our Additional Services

We support your trucking business beyond insurance. Explore our full suite of services:

📝 Authority Setup & Compliance

- MC Number Application

- BOC-3 Filing

- Unified Carrier Registration (UCR)

- Form 2290 Filing for HVUT

- FMCSA Portal Registration

- IFTA and IRP Registration

🏢 Business Formation

- LLC/Corporation Setup for Trucking

- EIN Application

- Operating Agreements

📋 State-Specific Services

- Georgia Intrastate Authority

- Apportioned Registration

- Georgia IFTA Registration

Start your application today:

👉 View All Services

FAQs: Commercial Truck Insurance in Georgia

Is commercial truck insurance required in Georgia?

Yes. Georgia law and the FMCSA mandate minimum levels of liability insurance for intrastate and interstate operations.

What’s the minimum liability requirement in Georgia?

It ranges from $300,000 to $5 million depending on cargo type and vehicle size.

Can I use personal auto insurance for my truck?

No. Personal policies do not meet legal or FMCSA requirements for commercial use.

How much is commercial truck insurance in Georgia?

Costs vary widely. It depends on driving history, truck type, and coverage limits. Contact us for a personalized quote.

Do I need cargo insurance in Georgia?

Most brokers and shippers will require it. It’s especially important for high-value or hazmat freight.

How can I lower my trucking insurance costs?

Maintain clean MVRs, bundle policies, use safety tech, and work with a specialist.

Does Georgia require special filings?

Yes, depending on the operation type, you may need Form E, H, or SR-22 filings.

Can I get coverage for my entire fleet?

Absolutely. Most providers offer fleet policies with volume discounts.

Is dump truck insurance different?

Yes. It includes specialized coverage such as environmental liability and higher physical damage limits.

What happens if I don’t have insurance?

Operating without coverage can lead to revoked authority, massive fines, and legal action.

Ready to Get Covered?

Your trucking operation deserves more than just the minimum. Whether you’re running hotshot loads, dump trucks, or reefer trailers, commercial truck insurance in Georgia is the shield that protects your investment.

🔒 Let’s protect your fleet the right way.

📞 Speak with a Georgia trucking insurance expert today or

📋 Get Started with Your USDOT & MC Number